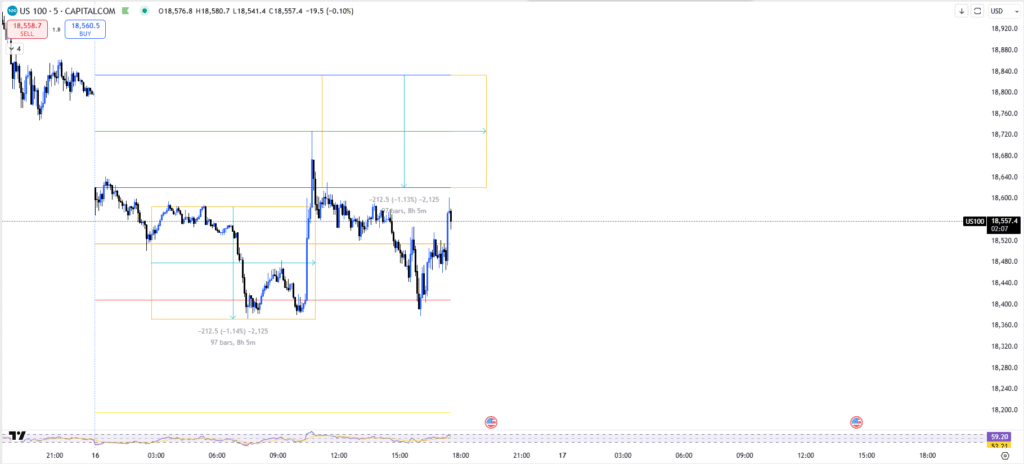

US100 Technical Breakdown: April 16, 2025 – Volatility Spikes with 212.5 Point Range by The Math Trader

The Nasdaq 100 (US100) showcased notable intraday volatility on April 16, 2025, trading within a 212.5-point range from peak to trough. This level of movement suggests increasing uncertainty in the tech-heavy index, making it a crucial session for day traders, swing traders, and institutional players alike.

🔍 Key Trading Metrics for April 16, 2025

- Opening Price: 18,555.1

- Session High: 18,560.8

- Session Low: 18,348.3

- Total Range: 212.5 points (~1.14% move)

- Closing Price: Around 18,554.3

- Volume and Volatility: Elevated, typical of market reversal or catalyst anticipation

🧠 Understanding the 212.5 Point Range Movement

A 212.5-point range represents a significant deviation for a 5-minute chart, especially within a single trading day. This level of volatility often correlates with key macroeconomic news, earnings surprises, Fed-related developments, or geopolitical influences. In this case, the chart shows:

📈 Morning Session: Bullish Breakout

- Early upside movement broke through the previous session’s consolidation zone.

- The breakout was sharp but short-lived, indicating profit-taking near local resistance.

- Traders capitalized on momentum early, pushing US100 close to 18,560.

📉 Midday to Late Session: Reversal and Retest

- After the initial rally, US100 reversed sharply by over 212.5 points.

- Support around the 18,340–18,360 zone held well, which could serve as a pivot for the next session.

- Market recovered slightly toward the close, forming a potential “W” reversal pattern.

🛠️ Technical Indicators and Patterns

- Price Action: Strong rejection at highs and support retests signal indecision.

- Fibonacci Zones: Retracements suggest possible consolidation or continuation.

- Support & Resistance:

- Resistance: 18,560–18,580

- Support: 18,340–18,360

- Volume Profile: Heavier volume at the bottom end signals accumulation.

📊 What This Means for Traders

🔸 Day Traders:

Volatility like this is golden. Scalping opportunities were abundant in both directions. The 212.5-point swing offered multiple entries with risk-reward setups.

🔸 Swing Traders:

Caution ahead. A breakout above 18,580 or breakdown below 18,340 would set the tone for a directional move. Range-bound trading is still likely short-term.

🔸 Investors:

Volatility is a double-edged sword. Today’s range may indicate the beginning of a larger correction or reaccumulation phase.

📅 Outlook for April 17, 2025

- Watch Levels:

- Upside Target: 18,600+ if momentum continues.

- Downside Risk: Below 18,340 opens doors toward 18,200.

- Catalysts to Watch:

- Fed commentary

- Earnings reports from major tech

- Economic data (jobs, CPI)

📷 Visual Snapshot: US100 Chart from April 16, 2025

The chart above shows the full range movement, key Fibonacci levels, and the timeframe of the sell-off and bounce. Notice the sharp drop mid-session and the V-shaped recovery heading into market close.

📌 Final Thoughts

The US100’s 212.5-point range on April 16, 2025, reflects a market trying to price in uncertainty. Whether this is the beginning of a larger trend or just noise within a broader range, traders need to remain adaptive, disciplined, and informed.

Stay tuned for tomorrow’s opening bell — it could set the tone for the rest of the week.

Disclaimer:

The information provided in this article is strictly for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All trading and investment decisions are made at your own risk.

The financial markets, including indices such as the US100 (Nasdaq 100), carry significant risk and may not be suitable for all investors. Past performance is not indicative of future results. Before making any financial decisions, please consult with a certified financial advisor. We are not responsible for any profit or loss that may occur as a result of decisions made based on this content.