US Stock Market Weekly Recap: S&P 500, Nasdaq Surge on Tech Rally | April 2025

Summary: The final week of April 2025 saw US equities extend their winning streak, led by a powerful rally in technology stocks. Investors balanced optimism from strong earnings and regulatory developments with ongoing concerns about tariffs and the global economic outlook.

Market Sentiment Overview

Investor sentiment was broadly positive throughout the week, with risk appetite buoyed by robust earnings from major tech companies and signs that the Trump administration may ease some tariff plans. The market’s momentum was further confirmed by the rare Zweig Breadth Thrust (ZBT) signal, which has historically preceded strong gains in the S&P 500 over the following 6 to 12 months.

Key Sentiment Drivers:

- Tech Optimism: Major tech firms like Tesla, Nvidia, Meta, and Alphabet posted strong results, fueling a sector-wide rally.

- Tariff Uncertainty: Ongoing negotiations and conflicting reports about US-China tariffs created some market jitters.

- Bullish Breadth Signal: The ZBT signal, triggered for the first time in years, reinforced bullish sentiment among technical analysts.

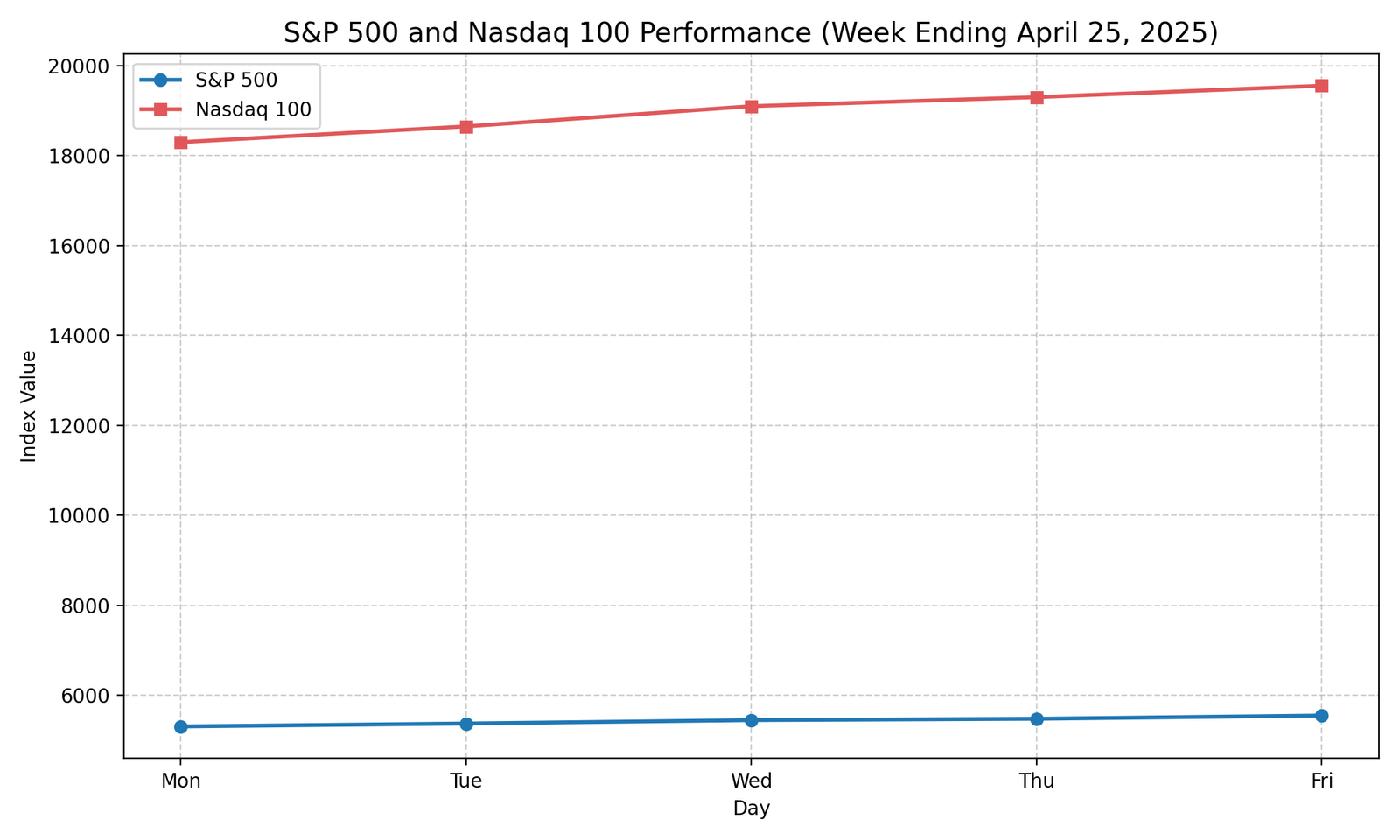

S&P 500 and Nasdaq Performance

S&P 500:

The index climbed 0.7% on Friday and finished the week up 4.6%, marking its second weekly gain in the past three weeks. The S&P 500’s advance was broad-based, but tech and communications services led the way.

Nasdaq Composite:

The tech-heavy Nasdaq surged 1.3% on Friday and posted a remarkable 6.7% gain for the week. This was driven by outsized moves in Tesla, Nvidia, Meta, and Alphabet.

Notable Movers:

- Tesla (TSLA): +18% for the week

- Nvidia (NVDA): +4% on Friday

- Meta Platforms (META): +3% on Friday

- Alphabet (GOOG): +1.5% on Friday

- Charter Communications (CHTR): +11% after strong subscriber growth

Economic Calendar Highlights

Key Events Last Week:

- GDP Data: US Q1 GDP growth above expectations

- Inflation: PCE inflation reading showed elevated but stable prices

- Jobs Data: Weekly jobless claims remained low

- Fed Watch: Expectations for continued rate hike pause

Looking Ahead:

Next week, markets will focus on the April jobs report, ISM manufacturing data, and further updates on US-China trade talks.

Technical & Breadth Analysis

The S&P 500’s completion of a Zweig Breadth Thrust (ZBT) is a rare technical event, historically followed by strong market returns. According to Carson Group, the S&P 500 has averaged a 6-month return of 14.8% and a 1-year return of 23.4% after such signals.

Commodities & Currencies Snapshot

- Gold Futures: $3,314.69 (steady)

- Oil (WTI) Futures: $63.18 (+0.64%)

- Bitcoin: $94,900

- EUR/USD: 1.1410 (unchanged)

Conclusion

The US stock market ended the week on a high note, with technology stocks leading the charge and bullish technical signals supporting further gains. While optimism is high, investors remain vigilant about trade policy developments and upcoming economic data.